Table of Contents

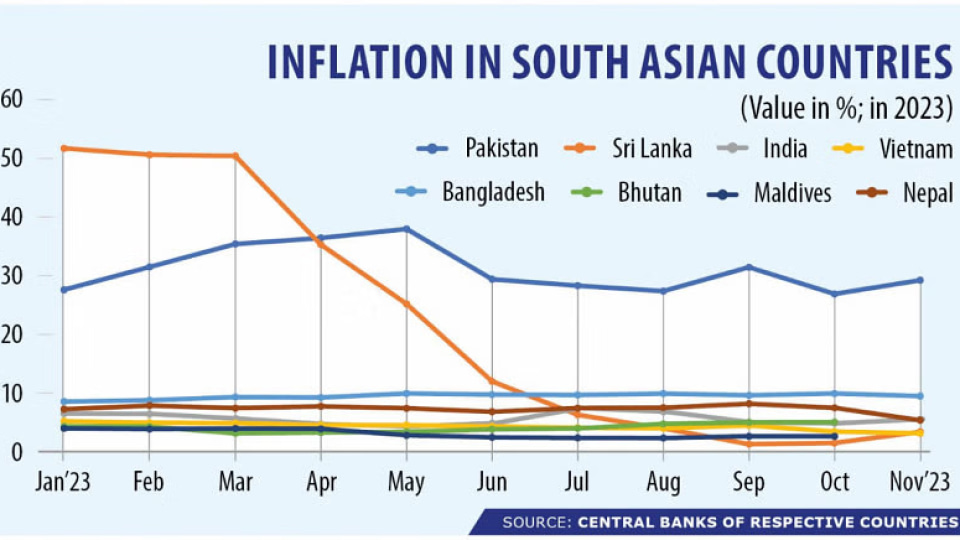

In a year marked by global economic uncertainties, most South Asian nations successfully navigated the challenges of taming inflation, providing relief to their populations. However, Bangladesh, alongside Pakistan, continues to grapple with the complexities of curbing soaring inflation, standing out in the region. The country witnessed an average increase in the Consumer Price Index (CPI) of 9.42 percent in November, underscoring the hurdles faced by the majority of the population in this lower-middle-income nation.

Regional Inflation Dynamics: Success and Struggles

While countries like Sri Lanka, India, Bhutan, the Maldives, and Nepal managed to rein in inflation, Bangladesh faces a persistent upward trend. Sri Lanka, in particular, overcame its worst economic crisis, reducing consumer prices following an unprecedented spike. In contrast, Bangladesh’s struggle to contain inflation persists, even as global commodity prices experience a recent decline.

Factors Influencing Bangladesh’s Inflation Surge

Bangladesh’s inflationary challenges stem from a combination of external and internal factors. Externally, supply chain disruptions post-Russia’s invasion of Ukraine and elevated commodity prices played a role. Internally, a 28 percent depreciation of the taka against the US dollar since February last year, foreign currency shortages, and a 30 percent drop in reserves leading to import restrictions contributed to the dilemma.

Economists and analysts criticize the central bank for underutilizing monetary tools, while the government’s delayed response to ensure market supply adds to the concerns. The sustained inflationary pressures in both urban and rural areas throughout the year indicate a need for timely and effective policy measures.

Comparative Inflation Trends in South Asia

A comprehensive analysis of CPI data across South Asian countries reveals varied inflation trajectories. Sri Lanka’s remarkable reduction from 51.7 percent in January to 3.4 percent in November is attributed to responsive monetary policy, base effects, weak demand, an appreciating rupee, and muted second-round effects, according to the International Monetary Fund (IMF).

Pakistan experienced a decline in CPI from a 12-month high of 37.97 percent in May to 29.23 percent in November, showcasing positive outcomes from appropriate policy measures. India, Bhutan, the Maldives, and Nepal witnessed a drop in prices, highlighting successful inflation control strategies.

Bangladesh’s Policy Responses and Criticisms

Experts point out that Bangladesh’s policymakers were slow to respond to inflationary pressures, resulting in elevated levels persisting throughout the year. The central bank initiated monetary tightening in July, stepping up efforts in October by raising the repo rate. However, criticisms arise due to the perceived inadequacy of these measures and their delayed implementation.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, criticizes Bangladeshi policymakers for refraining from utilizing monetary tools effectively. Zahid Hussain, a former lead economist of the World Bank Bangladesh, deems the measures as “too little and too late,” emphasizing the adverse impact of financing the budget deficit by borrowing from the central bank.

Coordination and Market Management Challenges

Market-driven lending rate reforms by the central bank face challenges, with critics highlighting the limited impact due to the 9 percent cap on lending rates until June this year. Large players in the food supply chain exploiting market power, import controls, and persistent foreign exchange shortages contribute to supply chain disruptions and inflationary pressures.

Experts stress the need for coordination between monetary and fiscal policies, emphasizing that effective market management and timely policy implementation are crucial to addressing inflation challenges. Selim Raihan, executive director of the South Asian Network on Economic Modelling, underscores the importance of both monetary and fiscal policies, emphasizing the delayed and belated nature of recent measures.

IMF Recommendations and Future Outlook

The IMF report emphasizes the pass-through impact of local currency depreciation on Bangladesh’s inflation surge in the last fiscal year. It suggests a gradual pace of monetary tightening may not be sufficient to stem second-round inflationary pressures, calling for further tightening to align with medium-term targets.

While inflation is expected to ease in the coming months due to contractionary monetary policy, market-based exchange rate measures, lower global commodity prices, and positive crop outlooks, challenges persist. Bangladesh Bank Governor Abdur Rauf Talukder anticipates a reduction in inflation to 6 percent by June, signaling ongoing efforts to navigate the intricate landscape of inflation control.

In a region where successes and struggles coexist, the path forward for Bangladesh involves comprehensive policy measures, addressing market dynamics, and ensuring timely and coordinated responses to economic challenges. As global uncertainties persist, the resilience and adaptability of South Asian economies remain pivotal in shaping their trajectories.